Central Govt. amends the criteria for classification of the enterprises under MSME

Central Govt. amends the criteria for classification of the enterprises under MSME

The Central Government after obtaining the recommendations of the Advisory Committee constituted on behalf of the Ministry of Micro, Small and Medium Enterprises (“MSME”), vide notification dated June 26, 2020, notified the criteria for the classification of the enterprises under MSME. The notification specifies the form and procedure for filing the memorandum and also the re-registration process of the existing enterprises under MSME. This reform alters the classification of an enterprise with a view to revive the MSMEs, amid COVID-19 pandemic.

What is a MSME?

The Parliament passed the Micro, Small and Medium Enterprises Development Act, 2006 (“Act”) on June 16, 2006. The Act provides for facilitating the promotion and development and enhancing the competitiveness of MSMEs. Under the Act, the erstwhile classification of the enterprises was on the basis of the investment in plant & machinery/equipment and further classified it into manufacturing enterprises and enterprises rendering services. In the manufacturing enterprises, micro enterprises were defined as having investments of not more than 25 lakhs rupees, small enterprises having investments of not more than 5 crores rupees and medium enterprises having investments not more than 10 crores rupees. Whereas, for the enterprises rendering services, the threshold was, micro enterprises defined as having investments of not more than 10 lakhs rupees, small enterprises defined as having investments of not more than 2 crores rupees and medium enterprises defined as having investments of not more than 5 crores rupees.

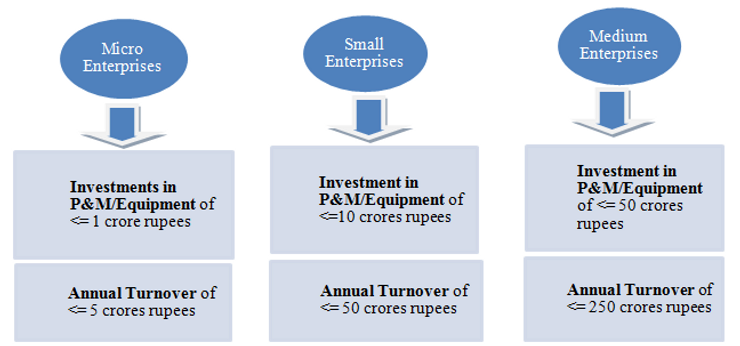

The recent amendment notified by the Ministry of MSME has done away with the distinction of manufacturing and service enterprises. Post Amendment, there is a single classification of the enterprises under the Act. The threshold to qualify as a MSME will consider the investment and annual turnover of an enterprise, and is as follows:

The new classification came into effect on July 1, 2020. All existing enterprises registered under the Udyog Aadhaar Memorandum (UAM) or Entrepreneurs Memorandum (EM)- Part II will have to re-register themselves to avail the benefits with respect to the recent classification. Failure on the part of the enterprises to re-register themselves will make them valid only up to March 31, 2020.

In order to protect the MSME sector, it has been kept under the purview of the Atma-Nirbhar Bharat Abhiyan, which was recently announced by the Hon’ble Prime Minister. The government has announced a collateral-free automatic credit line and a sub-ordinate debt for the stressed MSMEs. The government of India will act as a 100% guarantor for the enterprises availing loans under this scheme. Ministry of Finance announced the creation of ‘Fund of Funds’ with a corpus of 10,000 crores rupees. This would provide equity funding to MSMEs which possess growth potential and viability. The aim of the equity infusion is to encourage MSMEs to get listed on the main board of the stock exchanges. The government in its endeavour to make India self-reliant (Atma-Nirbhar) and to support the Make in India initiative, has disallowed global tenders up to 200 crores rupees for government procurement tenders.

Amendment and its impact

The Amendment has re-classified the criteria for classification of an enterprise under the Act. The MSME sector contributes significantly to the Indian economy in terms of Gross Domestic Product (GDP), exports and employment generation. This move would boost the MSME businesses and is much appreciated by the businesses at large as it provides a revival mechanism to these enterprises which have been affected due to the COVID-19 pandemic. It would also add more enterprises to register themselves as MSME, so as to avail the benefits of these reforms.

The MSME sector coming under the purview of the Atma-Nirbhar Bharat Abhiyan would act as a catalyst in the revival mechanism. This initiative would help the nation in self-procurement of goods and services and thereby, India’s trade balance would turn to a trade surplus. The debt restructuring mechanism for MSMEs and the creation of ‘Fund of Funds’ will enable the MSMEs to flourish which have been badly hit by the pandemic and to further infuse funds into their businesses to meet their operational liabilities, buying of raw materials or to restart their business.

Disclaimer: This is a general informative update and will not amount to legal advice. The opinions expressed here are general in nature and should not be construed as legal opinion. If you have any specific query on this update, we request you to reach out to our team for the relevant advice.

RECENT POST

SOCIAL SHARE

Related Post

Budget Takeaways 2024-25

Decoding Trends With Trumvir Law The Budget for FY 2024-2025, presented on July 23, 2024, aims to advance India’s growth

The Transformation of Criminal Law in India: A Comprehensive Overview

Decoding Trends With Trumvir Law India’s legal landscape witnessed a seismic shift on July 1, 2024, with the introduction of

Empowering Arbitration: The Advisory Centre on International Dispute Resolution

Decoding Trends With Trumvir Law I. Introduction On 8th July, 2024, the UN Commission on International Trade Law (“UNCITRAL”) adopted